Delve into the world of double-entry bookkeeping, a cornerstone of accounting. This guide offers an in-depth look at this crucial system, complete with practical examples in journal entry format.

Understanding Double-Entry Bookkeeping:

Double-entry bookkeeping is a foundational accounting system where every transaction affects two accounts, ensuring financial balance. This method provides a comprehensive view of financial transactions, crucial for accuracy and integrity in accounting. It’s a system that not only records financial activities but also provides a mechanism for error detection and financial control.

The Principle of Debits and Credits:

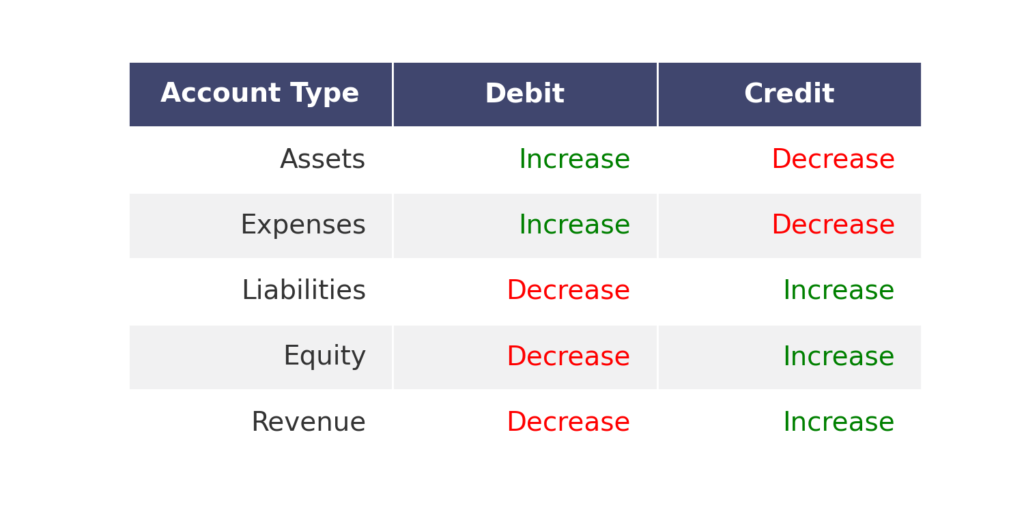

Every transaction in double-entry bookkeeping involves a debit and a corresponding credit. Debits typically increase assets or expenses and decrease liabilities or equity, while credits do the opposite. This balanced approach is essential for maintaining the accuracy of the accounting equation: Assets = Liabilities + Equity. Understanding this principle is key to effective financial recording and reporting.

Journal Entry Examples in Double-Entry Bookkeeping:

1. Purchasing Inventory on Credit:

Transaction: Buying $3,000 of inventory on credit.

Journal Entry:

Debit Inventory $3,000

Credit Accounts Payable $3,000

Explanation: This transaction increases both inventory (asset) and accounts payable (liability).

2. Cash Sales:

Transaction: Sale of goods worth $5,000 for cash.

Journal Entry:

Debit Cash $5,000

Credit Sales Revenue $5,000

Explanation: Cash (asset) increases and so does sales revenue (equity component).

3. Paying Rent:

Transaction: Rent payment of $1,200.

Journal Entry:

Debit Rent Expense $1,200

Credit Cash $1,200

Explanation: The transaction increases rent expense (expense) and decreases cash (asset).

4. Receiving a Loan:

Transaction: Securing a loan of $10,000.

Journal Entry:

Debit Cash $10,000

Credit Loans Payable $10,000

Explanation: Both cash (asset) and loans payable (liability) increase.

5. Owner’s Investment:

Transaction: The owner invests $20,000 in the business.

Journal Entry:

Debit Cash $20,000

Credit Owner’s Equity $20,000

Explanation: The transaction raises both cash (asset) and owner’s equity (equity).

6. Paying Off Debt:

Transaction: Repayment of a $4,000 loan.

Journal Entry:

Debit Loans Payable $4,000

Credit Cash $4,000

Explanation: The payment decreases loans payable (liability) and cash (asset).

Here’s a table summarizing the effects of debits and credits on different types of accounts in double-entry bookkeeping:

The Role of Ledgers in Double-Entry Bookkeeping:

Ledgers in double-entry bookkeeping are critical as they record transactions in their respective accounts. They serve as the primary tool for compiling and organizing financial data, essential for preparing accurate financial statements. Proper ledger maintenance is crucial for tracking a business’s financial health and analyzing its performance over time.

Mastering double-entry bookkeeping is essential for anyone in accounting or finance. This methodical approach ensures accurate and transparent financial records, supporting effective decision-making. Through understanding and applying its principles, one can gain deep insights into the financial workings of a business, laying the foundation for its success.